What the Bank of England history teaches us about how to protect our 401(K).

When I was a child, my least favorite subject in school was history. I hated memorizing meaningless dates for events that were meaningless to me. All that changed in 2000.

Early in the dot-com bust, I lost my well-paying job as a manager of a tech support team for a startup. With no money to entertain myself in my usual ways, and out of sheer boredom, I picked up the second volume of Durant’s Story of Civilization. And the rest is—history.

I could not put it down. I realized almost immediately I wasn’t merely reading an interesting book—I was acquiring the memory of our civilization. I wasn’t so much reading as I was recovering the memories of the deep past.

It took me two years to read all eleven volumes. I read daily, and it was the most absorbing part of my day. After I got a job I could not wait to get back home to read. The reading of these volumes changed me. It gave me a power I never knew existed – to mentally time travel into any place in the past. This acquisition of the civilizational memory remains the most singular experience of my life.

One profound concept that got through my thick skull during those heady reading days was the idea that if something had manifested itself in realty once, that thing can manifest in reality again. It may sound so obvious as to sound almost ridiculous. Yet it is the secret to peering into the dim fog of future.

Things return—like comets. Sometimes they recur regularly, sometimes not. Sometimes repeating throughout human life many times, like summers, and sometimes happening only once in a lifetime. Sometimes skipping many lifetimes.

Human life is too short to notice the Big Rhythm. But the life of civilization is long enough to witness many events that individual lives are oblivious to—events that keep coming back rhythmically. That’s why they say history rhymes.

To know what can happen in the future, it helps to know what has happened.

So what does the history of the Bank of England teach us about how we should take care of our 401(k)?

Let’s jump into our mental time machine, put on our seatbelts, set the dial a few centuries back—and let’s go.

…

Imagine you won the birth lottery and were born an English King. No, not Charles. Charles is a fake king—he manages charities. You’re born a real King, back in the medieval days, when your word was law, your sword was sharp, and your subjects were disposable.

Naturally, as an English King, you hate France. Who doesn’t? Honestly, you hate every country, but France gets the gold medal in your rage Olympics. Your dream? To see the French King begging at your feet. But to pull that off, your country must outproduce and outpower theirs.

How do you get that done? Easy.

You order your subjects to work very hard, produce goods, services, and knowledge. And on top of that base, you’ll have them make lots of superior weaponry. You issue a royal decree, and your serfs get to work.

But after a while, you notice your serfs mostly pretend to work hard. Their hearts and souls aren’t in it. You’ve barely moved the needle toward making yourself powerful. Crap!

What’s Plan B?

Perhaps you can free the serfs and pay them. They’ll be motivated to work hard, be creative, and invent new things, new techniques, and technology. You decide to give Plan B a spin.

You free the serfs, and you mint coins out of the gold in your treasury. Now you need to inject these coins into circulation. You’ll do that in two steps:

- You pay all your contractors, your government bureaucrats, and your army in this new shiny currency.

- You mandate that taxes paid to the Crown must be in the currency you minted.

This creates demand among all your subjects—they now have to hustle to earn it. With these two steps, you’ve created a circulation loop for your new money. You sit back with a goblet of mead and watch what happens.

Some time passes, and you notice Plan B works. Your people work hard and produce goods, services, and knowledge. And you finally have an economic base to produce lots of weapons. Cool. Soon, all French will be your bitches.

You just need to wait a little longer for the economy to grow a little bigger —so you become not just a powerful King but a more powerful King than the French King.

So you wait.

But then you notice the economy has stopped growing. It flatlines. WTF? Everything was going so good, what happened?

You send your ministers to investigate. They return with dreadful news: the economy stopped expanding because there’s not enough gold to allow the money supply to expand. And without a growing money supply, the economy can’t grow. Crap!

What now?

You summon your lab-coated wizards—the alchemists. They’ve bragged about turning base metals into gold. You’ve got copper galore. Let’s see some magic!

They fail. You decide they’re frauds and are about to have their heads handed to them on a plate. But then they fall to their knees and, with trembling voices, propose Plan C: “Sire, what if… we turn paper into gold?” You lean in.

The alchemists’ plan is to print paper notes instead of minting gold coins. Then promise the people that anyone who presents a paper note at the King’s palace will get the amount of gold written on the note.

“So how is this different than minting gold coins, you morons?” you growl threateningly at your alchemists.

“Have mercy, Your Majesty,” they whimper. “Here’s the secret ingredient of our plan—print more paper notes than there is gold in your treasury. Not all notes will be exchanged for gold. Paper is more convenient to carry than gold, and as long as people trust they can exchange this paper for gold, few will go through the actual trouble. Trust is the philosopher’s stone, the secret ingredient that turns paper into gold.”

The idea sinks in. You are blown away by its genius.

Let the royal mint print paper—lots of it! You run down the stairs into the basement where your mint is located, shouting, “Fiat lux!” (“Let there be light!”) Noticing you’ve confused your workers, you correct yourself: “Fiat lucre!” (“Let there be money!”)

And with those words, fiat currency is born.

The alchemists named their scheme a fractional reserve—only a fraction of the paper notes is backed by gold.

And it works beautifully. The economy starts expanding. You dust off your war boots. You kick French ass, and the French boots kick yours. The kicking goes back and forth for a few years. You burn a vast amount of raw resources on this war: metals, timber, food. Your country is now short of them. And you need to buy those from third countries. But third countries don’t want your paper money—they don’t really trust you—they want your gold. So you spend it—all of it.

Now that you’ve bought the raw resources, you print more paper money to push your economy forward and turn these resources into products and weapons. And, as before, you promise your subjects they can exchange the paper for gold. But at this point, it’s a fiction—you have no gold. Your subjects gradually discover the truth—the wealth they worked so hard for all their lives is just a pile of paper. They are disappointed. But who cares? That’s their problem. Your problem is that they lose trust in your money, and they stop working hard for it. Your economy tanks. Crap!

Now what do you do? Well, you’re a King, so you come up with Plan D—you confiscate gold from some of the nobles you dislike, get them executed for treason, and take their wives. Then you use the gold to continue the war against the French. But soon you’re out of that gold too. And now, everyone hates you, and no one trusts you. Your economy is dead in the water. Crap!

Now what? Enter Plan E. Your advisor whispers in your ear: There are wealthy nobles in England who have gold. Why not offer them a monopoly on issuing paper currency linked to the gold they possess? In exchange for that monopoly, have them give you loans. You’ll pay those loans back by mandating taxes be paid to the Crown in this new currency. You call this clever scam the Bank of England.

And it works. The people who own the Bank of England run it like a business. They are careful and disciplined—not running it into the ground like you did with your war hobbies. The economy grows by leaps and bounds. The Bank of England carefully and gradually increases the money supply to enable economic growth, but no more, to avoid inflation and currency debasement.

The Bank makes money on interest, and you get your loans paid back via the taxes you collect. Everyone is happy. The Bank of England runs the financial system and economy so well that your kingdom becomes powerful enough to conquer and enslave most of the planet, including a good chunk of the recently discovered New World. Life is sweet…

The crown’s experiment with private banking worked—so well, in fact, that centuries later, the New World would copy-paste the formula with its own imperial twist.

And now let us leave the Old World behind and fast-forward our time machine to 1971 in the New World. The Fed, modeled on the Bank of England, is running out of gold. The same old problem is responsible—endless wars. In particular, the Vietnam War has consumed an enormous amount of resources. So now the Fed is about to run out of gold. Crap!

What to do? There’s no time to waste—the link between gold and the dollar must be severed. Boom—done! The gold outflow from the vaults stops. Whew, what a relief. Wall Street throws a party. The stock market goes sky-high. Meanwhile, the dollar loses ~95.6% of its value relative to gold. That Grandpa’s retirement fund? Poof. Sorry, Gramps.

But if the dollar goes all the way to zero, then the State has a problem too. Crap!

So how do you stop the dollar’s slide toward zero if it’s no longer backed by gold? Back it with something else equally valuable. Offer a deal to the dictator of Saudi Arabia—offer to protect him in exchange for selling oil to the world only in dollars. The Saudi strongman agrees, and the link between the dollar and oil is established. Demand for the dollar picks up, and the plunge is arrested. The dollar is now called the petrodollar, and the economy stabilizes.

Now let’s fast forward to 2025 and look around. What do we find?

We see the State has staggering debt. We see the link between the dollar and oil is hanging by a thread. We see the Fed is insolvent. Due to bailing out folks who caused the 2008 financial crisis, its liabilities now exceed its assets. And we learn that the State wants more money for its “big beautiful” plans.

So now what? Well, the Bonnie and Clyde plan—hold up the Central Bank and make it print the damn money for you… err… the technical term is make them lower interest rates…

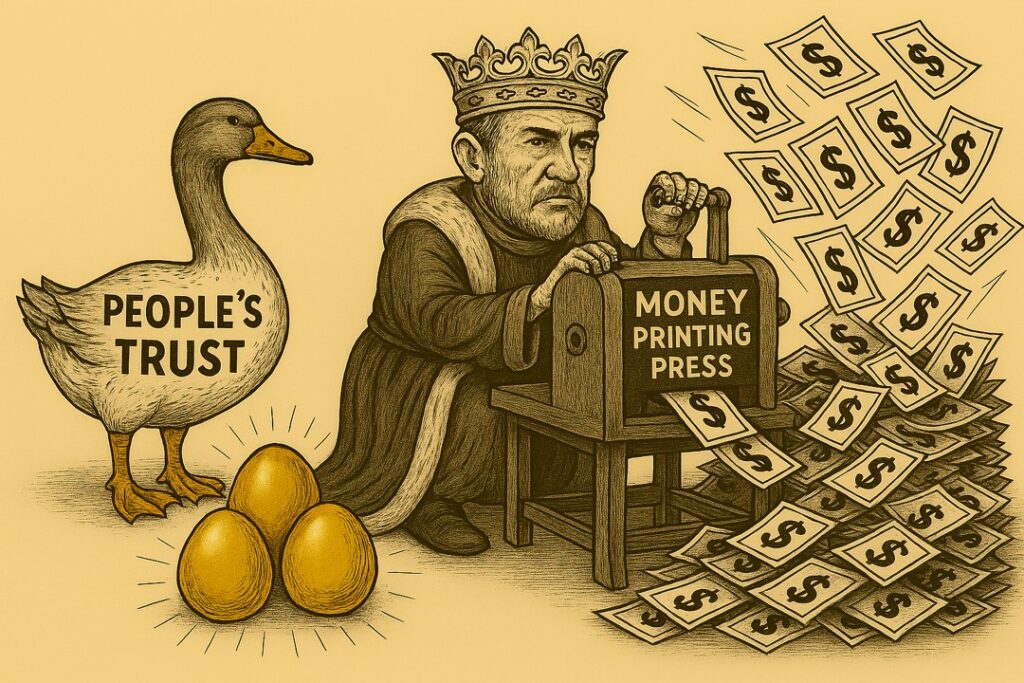

We may be coming full circle: the Bank of England was born from the wreckage of trust in State-issued money. But today, the State is gunning to get its hands on the Bank’s money printing press. It may succeed. But the State has dementia—it doesn’t remember the past. The goose that lays the golden eggs isn’t the printing press—it’s the people’s trust in the money. The trust is the philosopher’s stone of fiat money.

What happened long ago may happen again. If the State manages to grip the press, we must ask History: will it print prosperity—or will it print hardship?

In the next post, I’ll explore the possible financial implications of the State getting its hands on the printing press yet again.

Discover more from Laugh and Grow Rich

Subscribe to get the latest posts sent to your email.

Been messing around on 52bet1 for a bit. Seems like a reliable spot with some good odds. Might be my new go-to. You can try it out here: 52bet1.

Downloaded the Xoso66appapk! So far so good, seems pretty snappy. Gonna give it a whirl tonight. Def worth a download if you’re into this kinda thing: xoso66appapk

Gave Xsmbxoso666 a peek. Not bad, not bad at all. The site’s easy to navigate. Feeling lucky, might just throw down. Check it out yourself: xsmbxoso666