Tomorrow, I fly back home from Europe. This summer was immensely productive for me. Early in the morning I’d make a cup of “Dolce Gusto” coffee, spike it with amaretto liqueur for taste (the breakfast of philosophers), walk out onto a terrace overlooking the Black Sea and read . Then I’d make breakfast and spend the rest of the day for hours on end debating the mysteries of the economy with my faithful companions Grok and Chat, taking breaks for a swim and wondering how these two managed to stay so polite toward me even when I was clearly losing an argument. My evenings ended with a cigar at a tiny bar downstairs, discussing politics with locals —some of whom swore they knew how to fix the affairs of the state, provided they had total control and a few billion euros.

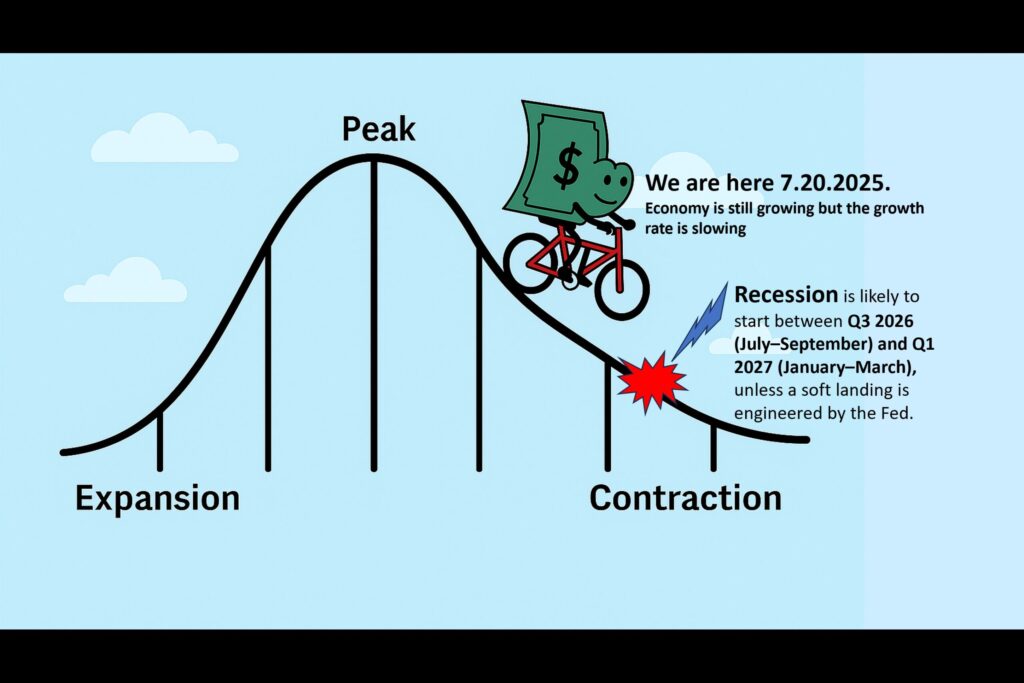

It turned out to be a creative summer. I extended the standard business cycle model to reflect my perspective, and both ChatGPT and Grok 4 gave me their thumbs up—unless they were just being nice, in which case I’ll take it anyway. Based on that enhanced model, I’ve put together a process for how an investor could ride the Business Cycle—preferably with a helmet on.

As my summer in Europe ends I have confidence in both the model and the process, so I’ll put them into action. But I won’t give recommendations to others just yet. The system is untested, and for all I know, there’s a bug in there plotting its own macro strategy behind my back.

So I will NOT recommend anything. Instead, I’ll journal my ride through the Cycle and document the lessons learned—some of which might be insightful, others embarrassing.

I’ll be using Ray Dalio’s five-step principle for continuous learning from mistakes:

- Go after Goals → 2. Encounter Problems → 3. Reflect and Diagnose → 4. Design how to get around the Problems → 1. Go after Goals again (a process that feels suspiciously like being stuck in an IKEA maze).

The vehicle I’ve chosen to ride the Cycle is Marc Faber’s portfolio: 25% Precious Metals, Stocks, Bonds, and Real Estate each. It’s simple, strategic, and—like a Swiss army knife—has just enough variety of tools for most of life’s situations.

As each next phase of the Cycle starts looming ahead, I’ll tilt the portfolio (but no more than 10%) and adjust the content of the asset categories. For instance, when heading into recession I’ll reduce stocks from 25% to 15% and rotate into defensive sectors. When riding out of recession, I’ll increase stocks to 35% and shift into growth sectors.

To protect against unexpected crashes, the portfolio will include a built-in “William Bernstein” safety feature: five years’ worth of my minimum living expenses tucked into short Treasuries. It’s like an airbag for my portfolio—hopefully never needed, but comforting to have when the yield curve decides to play chicken with my financial vehicle.

So, where are we in the Business Cycle now? My model suggests we’re in early contraction, with a potential recession looming between Q3 2026 and Q1 2027—unless the Fed manages to engineer a soft landing, which at this point sounds a bit like catching a falling piano with a silk pillow.

Of course, there’s always the possibility of an exogenous shock that could dramatically speed up the arrival of the downturn. A looming unfinished conflict with Iran, for instance, could lead to the closure of the Strait of Hormuz—delivering a seismic blow to the global economy. (Roughly 20% of the world’s oil flows through the Strait of Hormuz)

Given my model’s prognosis I am preparing the base portfolio in the following way:

(I am stressing that this is not a financial advice nor am I a financial advisor – I am simply journaling what I am doing)

- Increase Precious Metals to 30%—because if gold isn’t shining during a downturn, then nothing will.

- Reduce Stocks to 15% and rotate into defensive sectors like healthcare, dividends, value, and utilities.

- Increase Treasuries to 30%, leaning heavily on short durations—since long Treasuries are starting to look like that college girlfriend who used to be faithful but now had been caught cheating once or twice.

- Reduce Real Estate to 15% and favor healthcare and infrastructure REITs (buildings that matter even when the economy doesn’t).

- Add sprinklings of TIPS, foreign currency, and commodities to spice things up—because a little diversification never hurt anyone, unless you’re trying to explain it to your aunt over dinner.

The real challenge for any investor is to balance foresight with humility, especially when staring into the foggy future with only a flashlight and a few central bank press releases. It is not ours to know the future, but it is ours to anticipate. Being wrong about the future cannot be avoided, but being unprepared can be.

Discover more from Laugh and Grow Rich

Subscribe to get the latest posts sent to your email.

Alright, 456betgame! The gameplay is smooth, and I appreciate the fast payouts. Just be responsible, you know. Gotta keep it fun! See for yourself: 456betgame

I stumbled upon strv123b the other day and I was pleasantly surprised. The site is clean, the loading times are fast, and everything felt smooth. Give it a try y’all! strv123b